Last night the Treasurer, Josh Frydenberg, released the Government’s 2022-23 Budget. It featured a range of proposed measures including an extension of the 50% reduction to account-based (SMSF and Superannuation) income stream payments, targeted tax relief, and social security and aged care changes.

For a change, there was very little said about Superannuation, apart from the extension to reduced pension payments we’ve just mentioned.

Here’s a summary of the budget announcements, in addition to a short video presentation for those that prefer to watch than to read.

The 2022-2023 Federal Budget

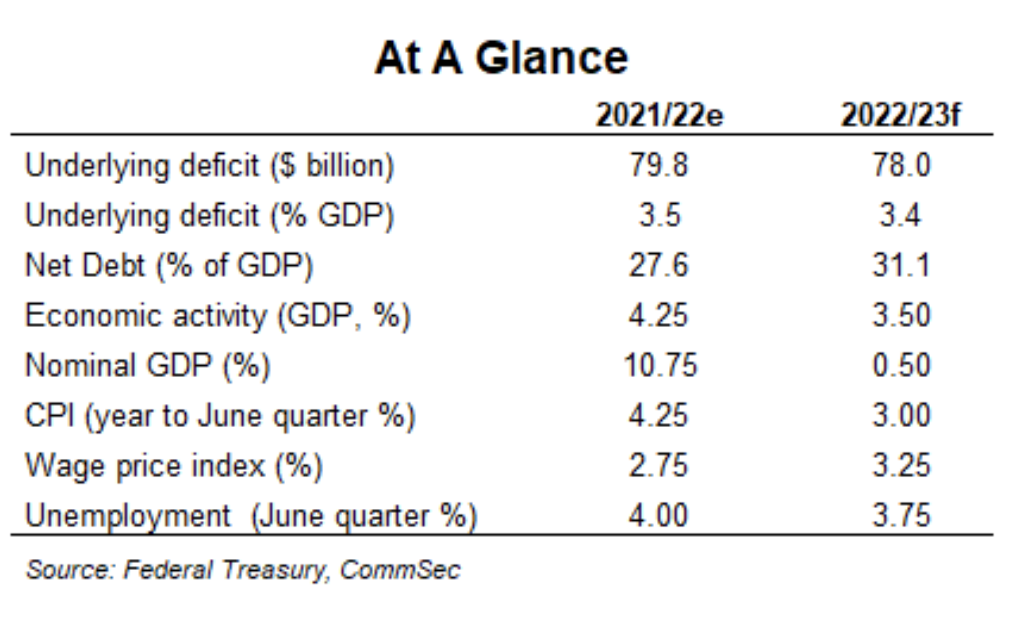

- Budget deficit of $79.8 billion (3.5% of GDP) expected this year (2021/22)

- Budget deficit of $78.0 billion (3.4% of GDP) expected next year (2022/23)

- Economy tipped to grow 3.5 per cent in 2022/23

- Net debt tipped at $714.9 billion (31.1 per cent of GDP) in 2022/23

- $17.9 billion lift in infrastructure spending (in excess of $120 billion over 10 years)

- Infrastructure details: https://minister.infrastructure.gov.au/joyce

- Focus is on cost of living relief for vulnerable Australians

- One-off cash payment of $250 for pensioners, welfare recipients, veterans and concession card holders

- Cut fuel excise by 50 per cent for six months

- Increasing low and middle income tax offset by $420 in 2021/22

- Bring forward of child care subsidy changes ($670m a year)

- $2.0 billion Regional Accelerator Program

- $7.1 billion investment in infrastructure projects in four key regions seen as export frontiers

- $9.9 billion over 10 years to deliver a Resilience, Effects, Defence, Space, Intelligence, Cyber and Enablers (REDSPICE) package

- Small business will be able to deduct a bonus 20% of the cost of business expenses and depreciating assets that support digital uptake

- $365 million to extend apprenticeship wage subsidies schemes

- $10 billion over two decades set aside for an east coast submarine base

- $1.2 billion over four years for an expanded Transition to Work scheme

- $800 million over 10 years for Antarctica

- $38 billion out to 2040 to recruit 18,500 new soldiers

- $875 million for 234 defence site projects including barracks and airfields

- Paid Parental Leave scheme integrating existing schemes

- $4.3 billion for a new dry dock facility in Western Australia

- $243 million for four projects under Modern Manufacturing Initiative

- Expanded home guarantee scheme

- $6 billion disaster support for flood relief in NSW and Queensland

- $480 million regional NBN upgrade

- $547 million for targeted mental health and suicide prevention initiatives.

- $331 million to promote the health of women and girls, including to support the National Women’s Health Strategy.

For more detailed information visit https://budget.gov.au/.