March 2024

Self-Managed Super Funds (SMSFs) continue to surge in popularity and value, representing a significant opportunity for advisers and accountants.

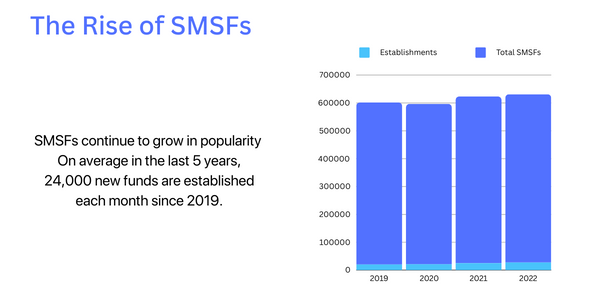

In fact, in the last five years, an average of 24,000 SMSFs were established each month, with higher average starting balances and younger trustees than ever before.

In the meantime, the number of registered advisers and SMSF auditors available to assist trustees with complex compliance and administration requirements has dropped. Indeed, today, almost half of SMSF funds are currently directly held.

Here are key SMSF statistics from recent research including the ATO’s latest SMSF snapshot, released last month.

SMSF Growth

There were 614,705 SMSFs with an estimated $913 Billion in assets recorded by the ATO in December 2023. The most popular assets held by SMSFs are listed shares (29 percent) and cash and term deposits (16 percent).

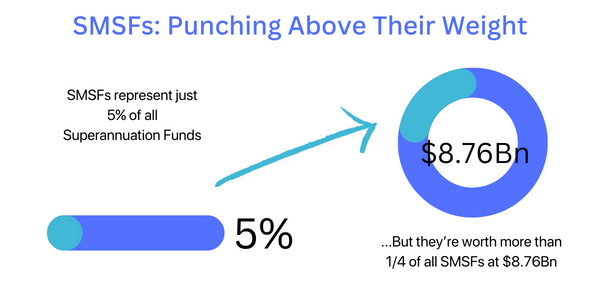

SMSF Values Punching Above Their Weight

Although they represent less than 5 percent of the nation’s superannuation funds, SMSFs account for more than ¼ of all assets held in Superannuation (worth a total $3.3 Trillion).

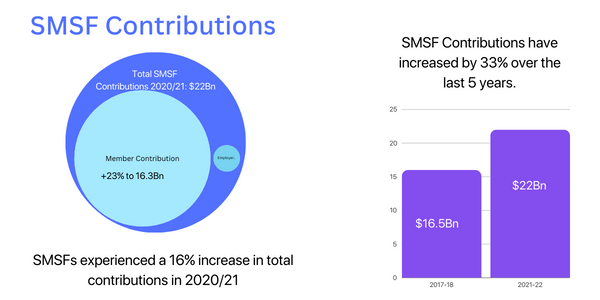

Investments in SMSF are on the Rise

SMSF contributions have increased by 33 percent in the last 5 years according to the ATO’s latest SMSF Profile.

Class Software’s Benchmarking Report reported the average annual contribution per member in 2021/22 of non-concessional (after-tax) amounts was just over $60,000. This illustrates how many trustees have significant disposable income to invest in their SMSFs.

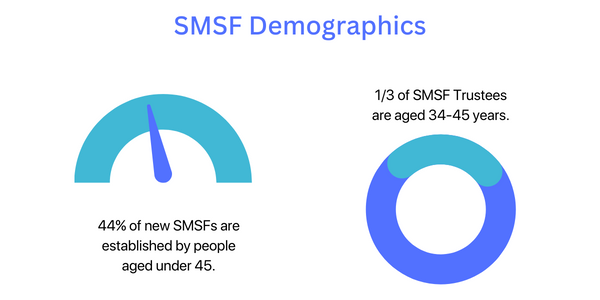

SMSF Demographics Changing

Gen X and Millennials are contributing to above-average growth of SMSFs in the last 5 years.

About 44 percent of trustees starting an SMSF are under 45, with 1/3 of new members aged between 35-45 years.

Why Are SMSFs So Popular?

Trustees are attracted to SMSFs because they seek greater flexibility over their superannuation investment options and more control. This is especially true during volatile economic periods.

Indeed, the COVID pandemic emphasised the importance of superannuation and broader investment options in younger Australians who have grown up with compulsory superannuation. Superreview.com.au found 47 percent of Aussies aged 18-24 regard superannuation more important now than before Covid.

The younger SMSF trustee of today also has more access to financial content from “finfluencers” and the internet. They’re certainly more active traders.

It is, however, very important that anyone considering starting an SMSF must have plans for how they’ll do better in an SMSF and speak to a licensed professional about their personal circumstances.

What Are The Downsides to SMSFs?

Compliance and administration are two of the largest pain points for SMSF trustees.

Issues like illegal early access to superannuation are also, currently, a major focus of the ATO and ASIC.

Regular reporting, audits and lodgement schedules can become complex and time-consuming for Trustees. Keeping on top of regulatory change is important. Non-compliance due to poor administration standards can lead to further costs and penalties due to late or non-lodgement.

Professionals Servicing the SMSF Market in Decline

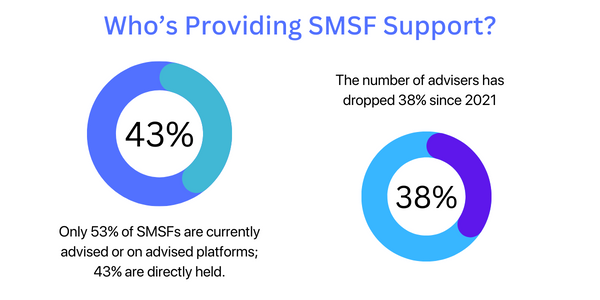

Meanwhile, since 2021, the number of financial advisers dropped by 38 percent.

Only 53 percent of SMSF funds are advised or on an advised platform, leaving 43 percent directly held.

The number of registered SMSF Auditors has also dropped significantly. A raft of regulatory change in recent years and stricter regulatory conditions for those working in SMSF is a major contributing factor.

Considering Establishing Yourself in the SMSF Market?

Since 2011, Intello’s SMSF experts have remained at the forefront of SMSF administration and compliance.

During periods of significant complexity, change and tighter regulation, Intello has continued to keep financial services businesses and their client SMSF funds compliant.

Today, the SMSF sector has experienced sustained growth, attracting younger trustees and active investors. With more SMSFs, fewer financial advisers and SMSF auditors in market, the SMSF market has strong potential for those finance professionals who have avoided the sector due to significant change that’s resulted in a more rigorous and more complex regulatory environment.

Intello’s SMSF experts are here to manage administration and compliance and any further change in this space on behalf of your clients with wholesale SMSF support too.