A profile of Australia’s SMSF Members – Aug 2021

Hello Trustees! Ever wondered if you’re the average SMSF Member… is your balance on par and are you older, or younger than most of your comrades?

The number of SMSFs has increased by 15% in the last five years to more than 590,000 funds. And while this represents less than 5% of Australia’s population, SMSFs account for more than one quarter of the total $2.9 trillion invested in superannuation (well done, You).

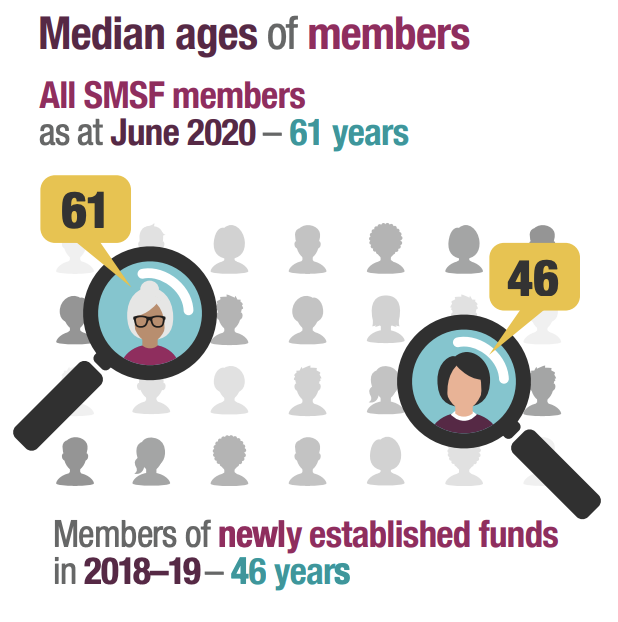

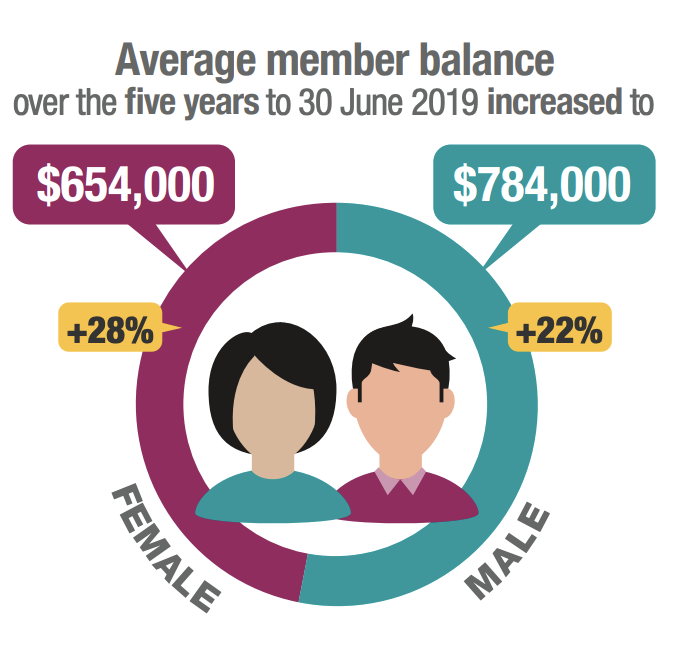

Younger people and more women are becoming more active in SMSFs in recent years, with 46 being the average age of members of newly established funds. Women are also growing their savings faster than men at 28% in the last five years, versus 21% for the same period for male SMSF members.

So, Are You in The Typical SMSF?

Seven out of ten SMSFs have two members; typically, an older married couple. The second most common structure is a single-member SMSF, which accounts for 23% of funds.

With only around 7% of funds having three members or more, it’ll be interesting to see if there’s an appetite for new allowances which provide for up to six members.

SMSFs are more popular in NSW than any other state with 33% of all members. Meanwhile, Victoria has 30%.

The Age of SMSF Members:

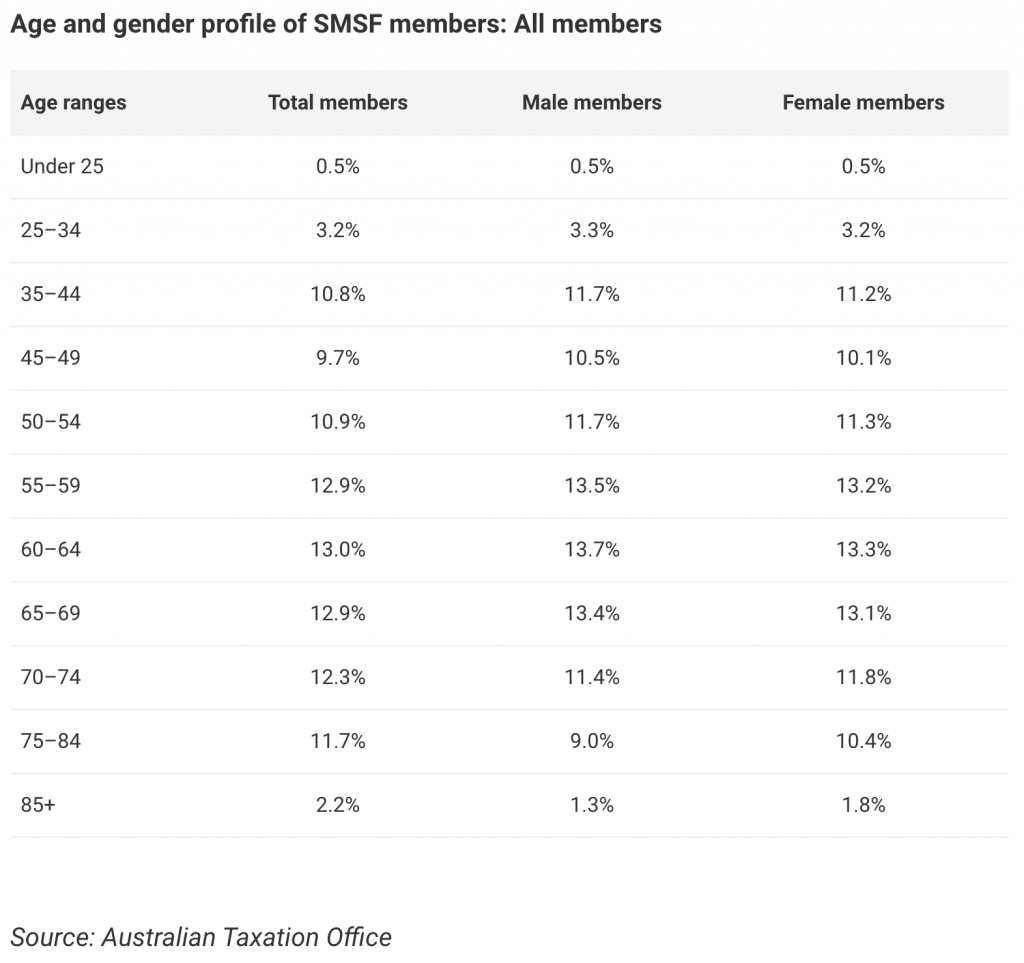

The most common age for members establishing their SMSF is between 35 and 44. The median age of all members is 61 years. But of those fresh funds, the median age is 46 years.

The majority of SMSF’s (at 55%) are currently in ‘accumulation’ mode. The proportion of funds in ‘retirement’ phase is 35%. Meanwhile, there are 10% of funds in a ‘partial’ accumulation/retirement phase. (Figures: in the year to June 30 2019. Source: the ATO).

Is your Superannuation Balance on Par?

Research demonstrates that the average self-managed super fund has a significantly higher balance than other types of super accounts – and values continue to progressively increase.

The average balance held by female SMSF trustee is $654,000 while their male counterparts have $784,000.

This, in comparison with research from APRA in 2020, the average 60-year-old male has almost $200,000 and females just under $166,000.

In fact, one quarter of SMSF’s have a balance between $500,000 – $1,000,000,000.

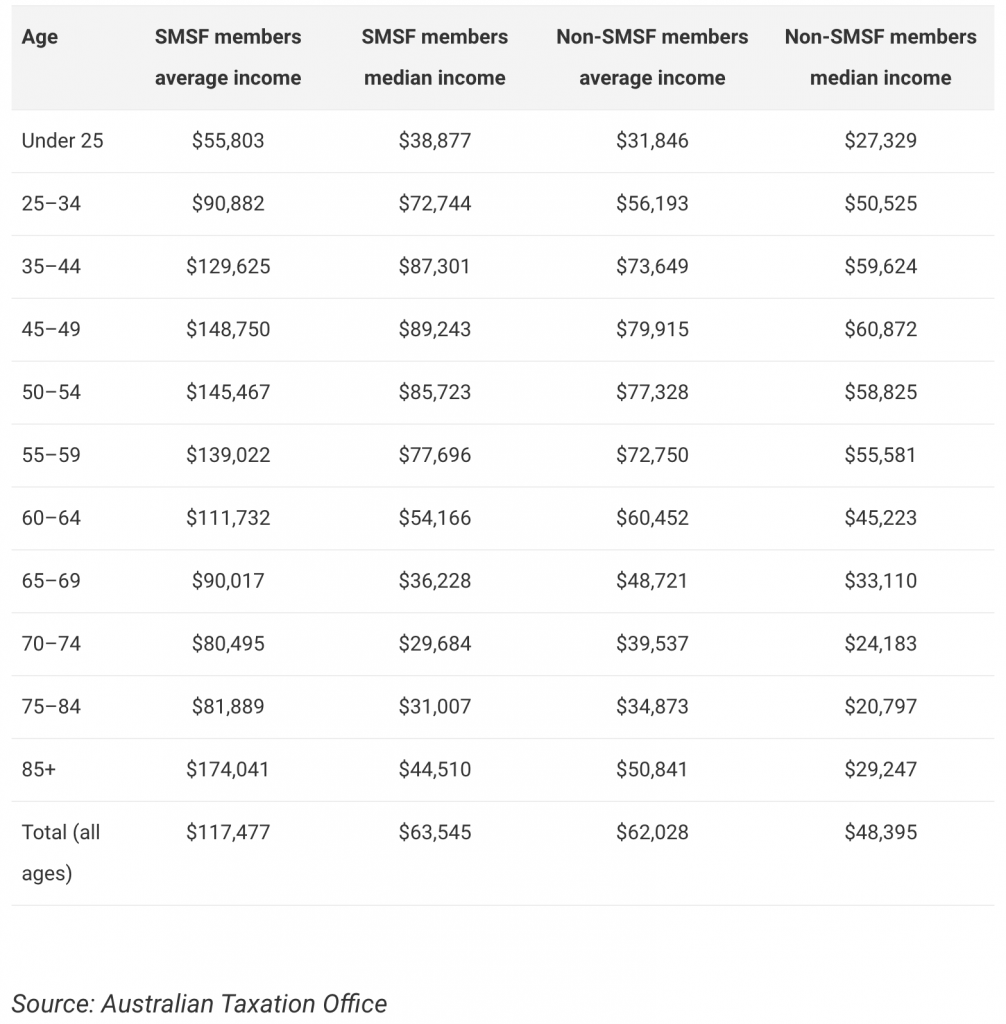

As you’d expect, the average taxable income for SMSF members is also higher than the national average, with SMSF members earning an average $117,000 compared to $62,000 for members of other types of super fund.

What ‘Type’ of SMSF Investor Are You?

In 2017 CBA and the SMSF Association reported on four core investor profiles amongst SMSF Members:

The most common type of SMSF Member is the ‘Controller’. This investor type seeks professional advice but ultimately want to maintain a high level of control over investment decisions.

- The Self-Directed Investor has a high level of confidence in their own abilities. As such, they’re less likely to seek professional advice in managing their fund or making investment decisions than the Controller.

- The Coach Seeker prefers to take a less active role in their investment decisions and managing their SMSF. They rely on professional guidance, but don’t outsource management and administration completely.

- The Outsourcer (as you would presume, from the name) almost completely outsources the day-to-day administration of their fund and investment decision making to a nominated professional.

For more on SMSF Accounting Services for Individuals available from Intello, click here or contact us.

Image sources: Unsplash & ATO.