This is the Second Article in Intello’s IFA Growth Guide. For the first article, click here.

The most successful businesses are those that scale efficiently. And for most industries, adding more customers and clients typically becomes cheaper as volume increases. Unfortunately, this is not always true for services businesses.

For example, the creative and attentive independent financial adviser is often rewarded with loyal clients and fantastic referral business.

This presents a problem for the adviser however, because business growth can quickly become limited by their availability, despite their excellent services. The pressures generated for the adviser by having more clients to service can also negatively impact service quality – unless the adviser removes some responsibility for tasks required to run the business.

Therefore, to avoid losing opportunities and existing customers in the pursuit of growth, it is important that financial advisers understand first, when it is a good time for growth of their business. Then they must become familiar with successful scaling strategies that don’t generate unnecessary risk or growth pains.

Advisers can certainly win the scaling challenge. They must strategically free themselves of low-value or highly specialised tasks, assigning them to someone else without detriment – or to the benefit of the client.

The most common methods of achieving scale in services businesses is to either:

- Automate or digitise processes, or to

- Outsource either specialist or low-value services.

One mistake often made by services businesses is they outsource as if it’s not important.

Deciding How to Scale Your Financial Services Firm

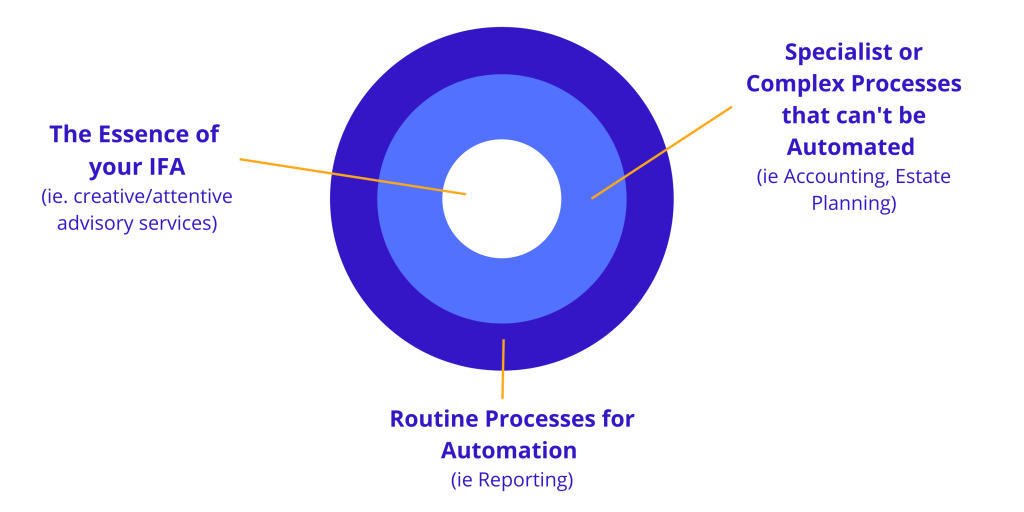

When deciding what to automate, what to keep in-house and what to outsource, you must first evaluate the core product of your firm. You need to analyse your business and break it into three core parts:

1. Your core business: those processes you will maintain as a unique or high-value service,

2. Those elements of the business that can be automated and

3. Those that can’t be automated and can be done better by someone else (outsourced via partnership).

Tip one: What to Keep In-House for Growth

Find what makes you and your firm irreplaceable from your client’s perspective. This must be preserved, like a secret sauce, as you scale your business.

Your strategic differentiators are likely to represent your core business. Maintain your strategic differentiators in-house. Everything else can go into the outer layers of what makes your product offering and either automated to drive efficiency or outsourced to remove the weight of time and responsibility upon you.

Tip two: What to Automate for Growth

Automation can be applied to standardised processes or digital systems like workflows or repeated processes.

The best way to automate is to those processes that are necessary and repeatable, and can be automated by digitalisation, automation or systems. This may be reporting, or routine lodgement workflows and communications.

Tip three: What to Outsource for Growth

There are two good ways to categorise what should be outsourced, either:

- Processes or services that are critical to the business but cannot be automated, or

- Activities that can be done better by someone else to save time and boost service levels.

One mistake often made by services businesses is they outsource as if it’s not important. But it’s the critical components of your business that should be executed by a partner. A classic example of this is going for offshore or cheaper service providers which is a danger, evidenced when Optus couldn’t provide support to its customers for an extended period during the first stages of the pandemic across Southeast Asia. Telstra also suffered massive negative press and volumes of customer complaints when they made the decision to offshore 8,000 jobs in 2019.

To help you in mapping what’s essential from the client’s perspective, or your core business you can use this value canvas, free at Strategyzer.

In the next Growth Guide Article, we’ll cover the topic of partnerships – specifically, what your ideal partner persona is, so that you can effectively implement a long-term growth strategy.

For more about Intello’s strategic partnered approach to SMSF Services for IFAs, contact us.