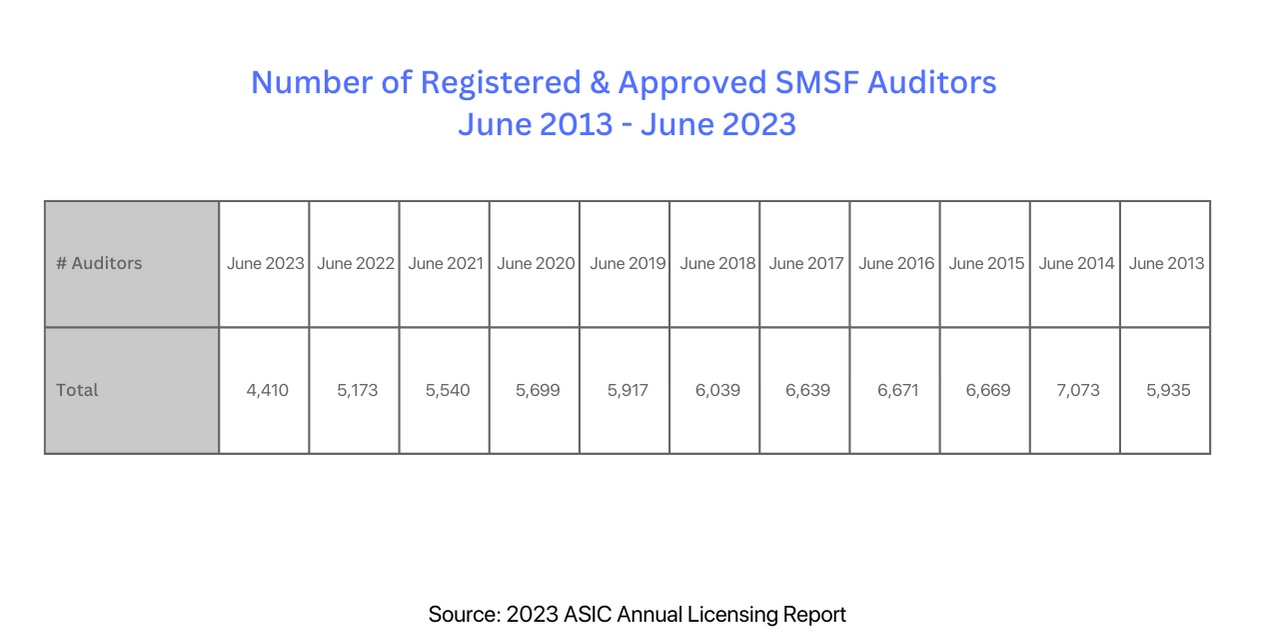

A lot has changed in the SMSF landscape since ASIC commenced registration of SMSF Auditors in 2013.

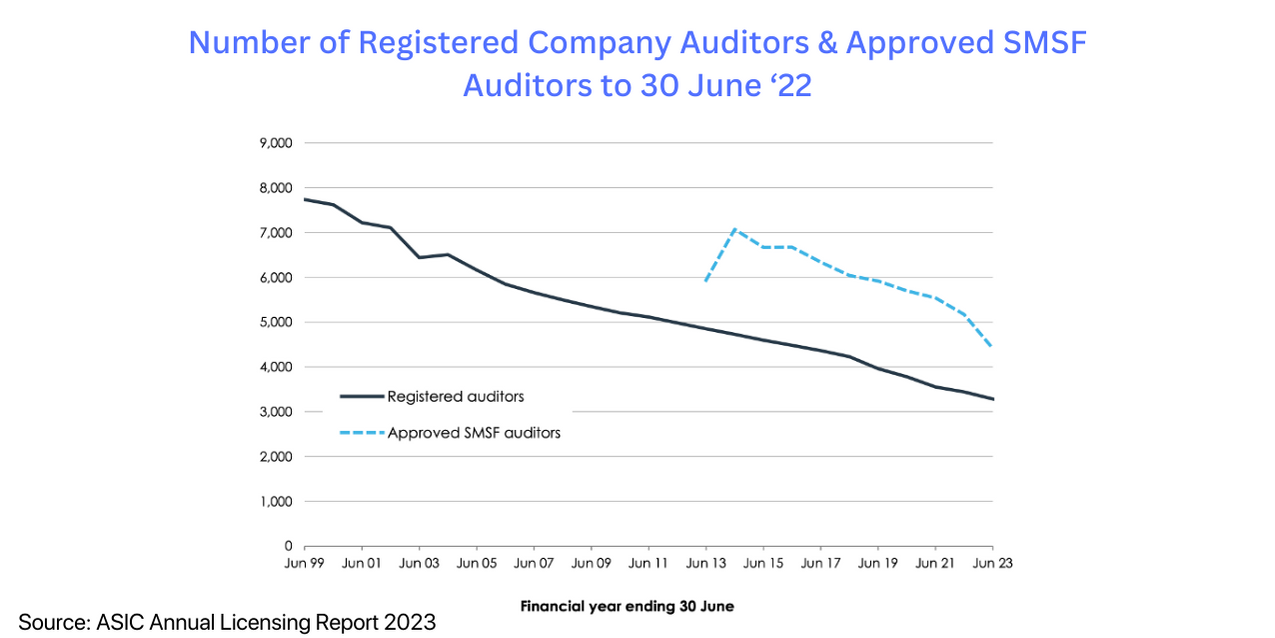

From a peak of more than 7,000 SMSF auditors in 2014, today, just 4,352 remain; in just a decade, the number of registered SMSF auditors has dropped by almost 40%.

Most (72%) of registered providers have left the industry in the last 5 years. The sudden drop in providers coincides with the lead up to auditor independence requirements which came into effect in July 2021. Consequently, a significant number of those auditors remaining had to adapt business models to shift audits from internal teams to new, external providers.

This, in addition to an increasingly complex regulatory environment and a multitude of recent legislation changes has transformed what was previously a cottage industry into one dominated by large market players powered by tech automation.

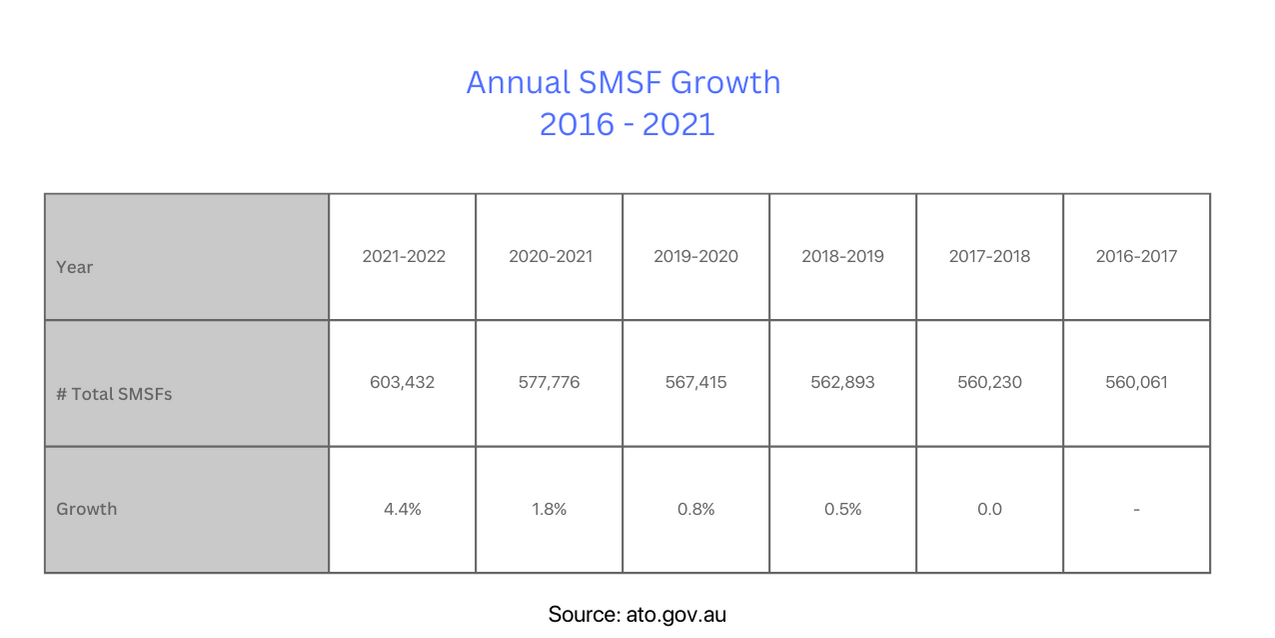

In the meantime, the number of SMSF funds continues to surge. In the five years to 2022, the number of SMSFs grew by an average of 24,000 new funds per annum. And the September quarter in 2023 saw the highest total of net funds established in the past five years.

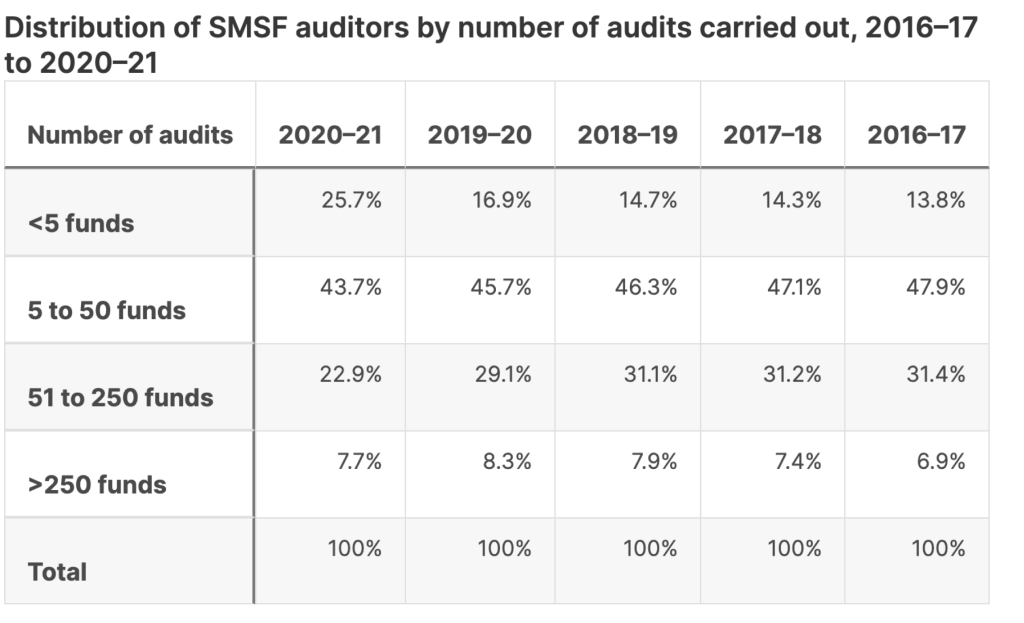

Of those SMSF auditors left, it’s a handful of major players capturing the market. The latest ATO SMSF Profile found SMSFs used 3,900 SMSF auditors across the country. Just eight percent of the 3,900 providers performed work on 250+ funds that year, representing 68 percent of the market.

Indeed, attrition of the SMSF Auditors Sector appears to be over-represented by smaller providers. In the last decade, the number of auditors performing work on 250+ funds has grown from 53 percent to 68 percent. A lot of this work would have formerly been executed by firms with a smaller number of funds, who can’t access the tech that is priced for bigger business. This explains how, when the number of SMSF funds has skyrocketed, the rate of audits completed remains steady, despite shrinkage in auditor options.

Surprisingly, despite a drop in competition and increased demand, auditor fees have not gone up. Instead, they’ve dropped from 2017 levels according to data from the ATO. This may be attributable to the efficiencies and scale of software used by larger SMSF auditing firms.

Tougher SMSF Auditor’s Market Conditions Generates Churn

The numbers we see leaving the market are a combination of voluntarily leaving, and ASIC deregistering more 470 SMSF auditors. Most of those removed by ASIC were due to a failure to submit annual statements.

By January 2023, 374 SMSF auditors have been removed from the ASIC register. Most due to a failure to submit annual statements. It’s highly likely this is a clever way to trigger deregistration by the regulator to avoid a near $900 fee and dip out of a more complex and sophisticated industry. Since, the ATO recently reduced the deregistration fee from $899 to $193 to make a voluntary industry exit easier.

It’s evident that regulatory conditions have also contributed to churn. In 2021/2022, of 300 de-registered, 47 or 16 percent were actioned by ASIC. Of those deregistered by ASIC, 19 (40 percent) were due to poor standards, and 18 (38 percent) found to have reciprocal audit arrangements.

As we watch legislative change and market forces play out, it’s worth considering the result for SMSF Trustees and professionals. Has the ATO and ASIC used regulatory requirements, mandatory CPD and most recently, lower deregistration costs to intentionally evolve the SMSF audit industry into one that is more consolidated and tech based? Or will a market with reduced competition eventually lead to higher SMSF audit fees? It’s difficult to tell, but as long as SMSF fund audits continue to be completed, it’s interesting to watch the dynamic industry.