Facing rapid market change and regulatory conditions, Aussie financial services firms are partnering with third-party firms more than ever before.

Most often, this is an economic decision to remove tedious low-value work from teams who can focus on high-yielding activities, by re-allocating the services to regions with lower pay.

Meanwhile, some firms opt to enhance business value by introducing new income streams and services to clients without directly hiring skilled specialists for niche work.

Today, one in four SME financial services firms in Australia report offshoring some components of their processes to overseas third-parties. In seeking a competitive advantage, the offshoring strategy is not without its risks. The COVID-19 pandemic has illuminated some of the issues related to selecting offshore third-party partners.

Service Level Agreements

Since the pandemic, extended lockdowns in regions such as the Philippines and India have triggered a decrease in output from the offshoring industry. This has contributed to workflow issues, and unintentional breaches of client contracts for those companies offshoring to highly affected regions.

Exposure to performance issues has recently fuelled politicians and policymakers to advocate for a reduction in the outsourcing-offshore business practice, including the return of local manufacturing to Australia.

While the pandemic has generated ‘unprecedented conditions’, it demonstrates how overseas environmental factors can impact the availability of businesses to service your firm and your clients.

Cybersecurity Considerations

Technology has simultaneously paved the way for the massive growth experienced by the offshoring industry and exacerbated cybersecurity concerns for businesses that offshore.

Research has demonstrated the more complex the financial services supply chain, the more surface area of opportunity for malicious actors. Indeed, cybercriminals took advantage of vulnerable supply chains as businesses reconfigured to outsource business processes overseas and work from home (WFH) during the pandemic.

And while cybersecurity is a concern for all industries, it is especially true of the financial sector. IBM Security’s Data Breach Report 2020 found our financial services sector is the third highest target of cybercriminals in Australia, where the average direct and indirect costs of a data breach is $5.85million.

When selecting a third-party outsourcing partner, it’s important to prioritise those with the strictest cybersecurity measures. This extends beyond technical security measures like firewalls to cybersecurity awareness and education amongst work teams to reduce your client data risk to phishing scams and social engineering.

It’s important to note that, in July 2019, all APRA-regulated entities, including banks and insurance companies, must adhere to a new standard for information security. The CPS 234 standard requires services to have an appropriately sized information security capability.

Where information assets are managed by a related party or third party, the APRA-regulated entity must assess the information security capability of that party, commensurate with the potential consequences of an information security incident affecting those assets.

Data Security Considerations

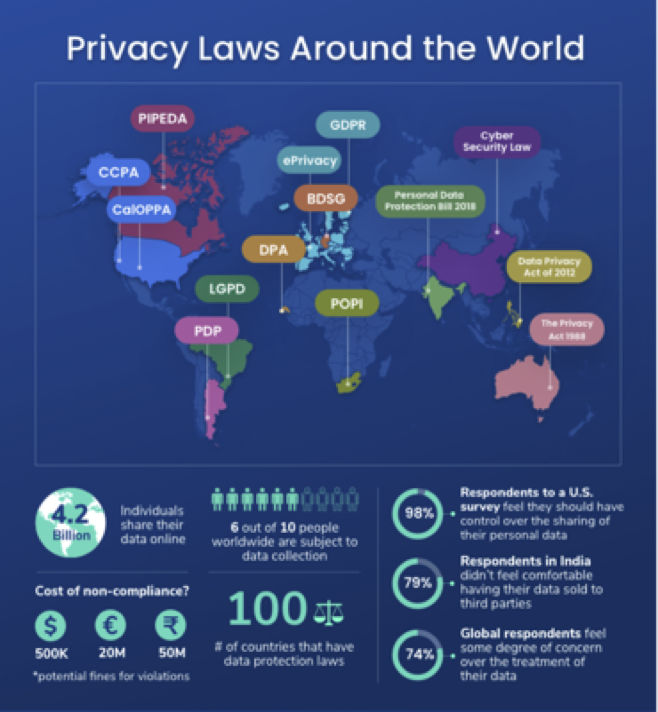

Similarly, another complexity for businesses offshoring is navigating different data privacy laws. There are currently 100 countries with varying data privacy policies which are designed to protect personal and sensitive customer data from misuse by applying standards for data use, storage, and processing. Countries such as the U.S and Australia have passed regulations mandating the client notification of data breaches as soon as a breach occurs, but standards vary.

In July last year, Australia’s information and privacy commissioner, Angelene Falk, called for changes to legislation designed to facilitate data-sharing with other countries to provide better safeguards to protect Australian citizens’ personal data.

A report by Capgemini found as long as data protection standards vary across the world, it “comes at a cost to financial firms with multinational operations and offshore outsourcing partners”. Governing bodies have vowed to resolve the issue by cutting down excessively bureaucratic processes to unify standards as much as possible however, the process is slow and complex.

Customer Expectations

When compared with our nearby neighbours, Australia’s relatively high labour costs are a major influencer in the decision to offshore. However, direct and indirect costs associated with outsourcing work to regions where poor working conditions – including painfully low wages – degrade service quality through high staff turnover, interruption to services and communication issues. This is exemplified in Telstra’s decision to offshore 8,0000 jobs in 2019 and corresponding rise in consumer complaints.

Client satisfaction should remain a focal point of your decision to outsource work. When a change in service directly impacts a customer’s perception or standard way of doing business, satisfaction levels are tested.

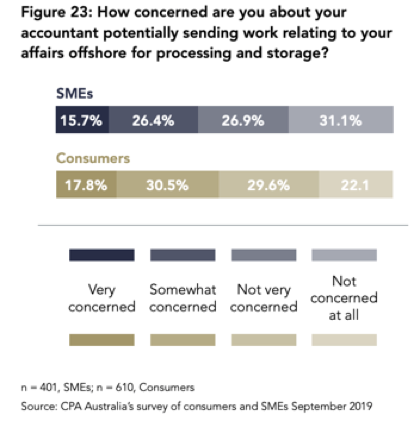

The impression of sending local jobs overseas in the current economic environment triggered by COVID-19 is potentially very costly to business. Even before we could imagine a global pandemic and economic recession, CPA Australia’s 2019 My Firm, My Future Report found that SMEs and consumers are concerned about their accountant sending work offshore, and that they would be prepared to pay more for their accountants’ services if their information and data was stored or processed only in Australia.

Before choosing to engage an outsourcing provider that operates offshore, you should ensure that clients understand and are willing to accept any change to services and use of their data.

Outsourcing partnerships most often run into issues when one or more of these factors were not considered or communicated from the outset between you and the third party, your staff or your clients.

Opportunities to Save, Build Business Value and Delight the Client

Another layer to consider on top of consumer concerns for data security and local jobs is Smart Company’s recent article suggesting that the decision to offshore to save money, rather than other means such as automation via technology is a short-sighted strategy.

The opportunity to automate processes has significant impact on business capacity by removing a lot of grunt work. This can free up staff to expand their roles and deliver more business value. Greater visibility into funds and more digital experiences are also very reliable ways to delight customers.

Indeed, this is how Intello provides specialist SMSF Accounting and administrative services at accessible rates – all while supporting Aussie jobs. A focus on the niche of SMSF accounting has allowed Intello to refine workflows and optimise technology, so we can pass on savings to the client as lower fees without any sacrifice to service quality.

In fact, Intello clients can offer their client a digital customer service, specialist SMSF skills and maintain time for customer-facing, high-value services with confidence in service levels and security measures. On-shoring is an effective alternative to offshoring that removes many complexities and risk demonstrated during the pandemic. With one in four Aussie financial services firms offshoring, this also provides one in three businesses to differentiate themselves by selecting to partner with a specialist that supports Aussie jobs.

For more information about our 24-7 online client portal and other innovative approaches to SMSF Administration services, contact us.